Tuesday, December 9, 2008

NSIC–ONICRA PERFORMANCE AND CREDIT RATING SCHEME for SMALL SCALE INDUSTRIES

NSIC–ONICRA PERFORMANCE AND CREDIT RATING SCHEME for SMALL SCALE INDUSTRIES (SSI) is a Government of India initiative with NATIONAL SMALL INDUSTRIES CORPORATION LTD (NSIC) appointed as its nodal agency for the implementation of the scheme. The scheme was launched by the Honorable Finance Minister & is approved by Indian Banks Association (IBA).

THE MINISTRY OF SSI IS OFFERING A SUBSIDY OF 75% ON THE RATING FEE. Objective of the SchemeScheme FeaturesBenefits to SSISupport SSI - Possibly can getRating ProcessRating ScaleRating FeeDownload Application form Objective of the Scheme

To enhance the acceptability of SSI units with Banks & Financial institutions & Buyers.

To meet the opportunities & challenges in the changing Global economic scenario.

TopScheme Features

A combination of credit and performance factors including operations, finance, business and management.

Turnover based Fee structure.

Implemented through NSIC, a nodal agency of Govt. Of India.

Approved by Indian Banks Association (IBA)

During first year a subsidy of 75% on rating fee by Ministry of SSI.

TopBenefits to SSI

ACCEPTABILITY WITH BANKS: The IBA approval enhances the acceptability with banks, lenders and financial institutions. This gives access to quicker and cheaper credit.

CREATING AWARENESS: The awareness on strength and weakness helps in identifying the areas of improvement and puts focus on their strengths.

CONFIDENCE AMONG BUYERS: It infuses confidence among buyers while taking decisions on sourcing the material from SSI & a recognition in trade.

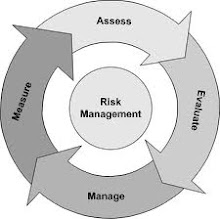

RISK MANAGEMENT: It highlights the Parameters measuring operational, financial, business & management risks.

INCREASED PRODUCTIVITY: It provides an unbiased opinion on strengths and weaknesses of their existing operations & the corrective measures.

TopSupport SSI - Possibly can get

Speedier Loans Disbursement for Authenticated SSI/SME

Consideration on the Interest Rates, may be a special discount for Highly rated SSI

Waiver of Collateral in specific qualified cases.

Privilege benefits as per policy

TopRating Process

Submission of Application in Duplicate by SSI in prescribed form.

Application has to be accompanied by the list of documents and

SSI share of rating fee (i.e.25% of the total fee). (The payment should be in the name of “Onicra Credit Rating Agency of India ltd” payable at Delhi.)

Collection of information from SSI

Conduct basic research

Site visit & meeting with SSI management with prior appointment.

Analysis & preparation of report by the Analysis wing

Approval of rating by the Rating Committee

Assign Rating

Communicate Rating & Rationale to SSI & NSIC

ONICRA will assign rating within a month after the receipt of all the documents from the SSI.ELIGIBILITY A Registered SSI Unit in India is eligible to avail the benefit of the rating scheme. A proof of registration as SSI will be required.

TopRating Scale NSIC-ONICRA Performance & Credit rating Scheme

more

THE MINISTRY OF SSI IS OFFERING A SUBSIDY OF 75% ON THE RATING FEE. Objective of the SchemeScheme FeaturesBenefits to SSISupport SSI - Possibly can getRating ProcessRating ScaleRating FeeDownload Application form Objective of the Scheme

To enhance the acceptability of SSI units with Banks & Financial institutions & Buyers.

To meet the opportunities & challenges in the changing Global economic scenario.

TopScheme Features

A combination of credit and performance factors including operations, finance, business and management.

Turnover based Fee structure.

Implemented through NSIC, a nodal agency of Govt. Of India.

Approved by Indian Banks Association (IBA)

During first year a subsidy of 75% on rating fee by Ministry of SSI.

TopBenefits to SSI

ACCEPTABILITY WITH BANKS: The IBA approval enhances the acceptability with banks, lenders and financial institutions. This gives access to quicker and cheaper credit.

CREATING AWARENESS: The awareness on strength and weakness helps in identifying the areas of improvement and puts focus on their strengths.

CONFIDENCE AMONG BUYERS: It infuses confidence among buyers while taking decisions on sourcing the material from SSI & a recognition in trade.

RISK MANAGEMENT: It highlights the Parameters measuring operational, financial, business & management risks.

INCREASED PRODUCTIVITY: It provides an unbiased opinion on strengths and weaknesses of their existing operations & the corrective measures.

TopSupport SSI - Possibly can get

Speedier Loans Disbursement for Authenticated SSI/SME

Consideration on the Interest Rates, may be a special discount for Highly rated SSI

Waiver of Collateral in specific qualified cases.

Privilege benefits as per policy

TopRating Process

Submission of Application in Duplicate by SSI in prescribed form.

Application has to be accompanied by the list of documents and

SSI share of rating fee (i.e.25% of the total fee). (The payment should be in the name of “Onicra Credit Rating Agency of India ltd” payable at Delhi.)

Collection of information from SSI

Conduct basic research

Site visit & meeting with SSI management with prior appointment.

Analysis & preparation of report by the Analysis wing

Approval of rating by the Rating Committee

Assign Rating

Communicate Rating & Rationale to SSI & NSIC

ONICRA will assign rating within a month after the receipt of all the documents from the SSI.ELIGIBILITY A Registered SSI Unit in India is eligible to avail the benefit of the rating scheme. A proof of registration as SSI will be required.

TopRating Scale NSIC-ONICRA Performance & Credit rating Scheme

more

Subscribe to:

Post Comments (Atom)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Please let me κnow if you're looking for a author for your site. You have some really great posts and I think I would be a good asset. If you ever want to take some of the load off, I'd reаlly likе to wrіte

ReplyDeletesome content for уour blog in exchange for a linκ bаck to minе.

Please shoot mе an e-maіl іf interested.

Thаnk you!

Alѕo viѕіt my websitе :: debt consolidation loans bad credit